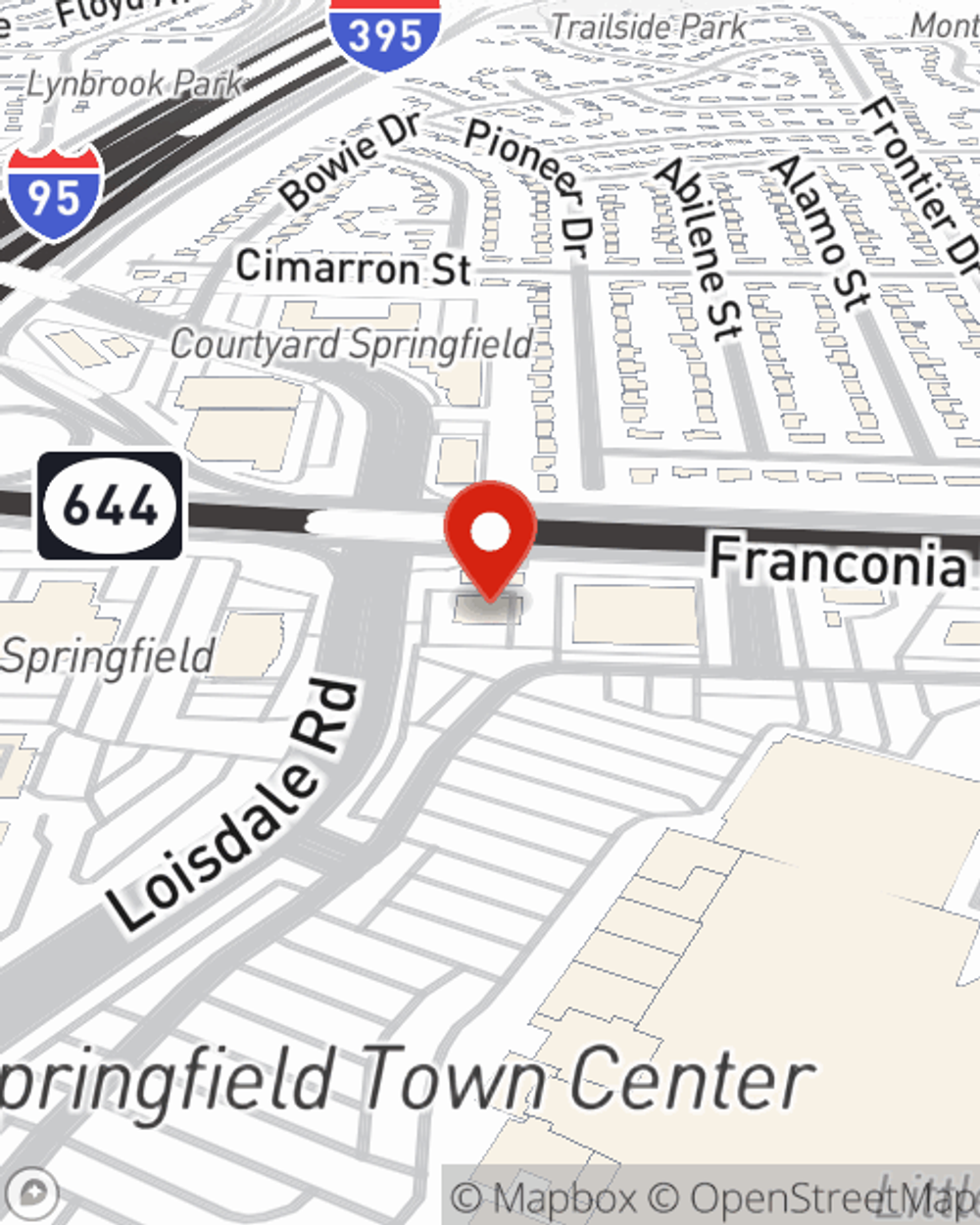

Business Insurance in and around Springfield

One of the top small business insurance companies in Springfield, and beyond.

No funny business here

This Coverage Is Worth It.

Whether you own a an antique store, a bakery, or a stained glass shop, State Farm has small business protection that can help. That way, amid all the different decisions and moving pieces, you can focus on your next steps.

One of the top small business insurance companies in Springfield, and beyond.

No funny business here

Customizable Coverage For Your Business

The passion you have to serve your customers is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Craig Griffith. With an agent like Craig Griffith, your coverage can include great options, such as business owners policies, commercial liability umbrella policies and worker’s compensation.

Let's discuss business! Call Craig Griffith today to discover why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Craig Griffith

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.